How did it get

so bad?

By Jeroen Blokland,

Published on May 23, 2023

In the first episode of this series, I argued that we should not overestimate our knowledge about inflation. Given the erratic behavior before the 1950s, we cannot rule out that the last 40 years of lower inflation have been the outlier. And US inflation averaging 8.0% in 2022 may very well confirm this. But why did things get so bad? And was 2022 an exception, or should we brace for an extended period of high inflation? Let’s find out in this second episode of ‘Inflation and Investing.’

In short, there are three main reasons why inflation ballooned across the globe:- Unprecedented fiscal and monetary stimulus

- Supply chain destruction

- The big mistake: Energy

Jeroen Blokland, founder of True Insights - offering independent investment research and portfolios enabling investors to implement a comprehensive and proven multi-asset investment approach.

Unprecedented Fiscal and Monetary Policy

The first, and perhaps most important, cause of spiking inflation is the unprecedented fiscal and monetary policy following the Covid crisis. Only now that Covid is decisively behind us can we ‘value’ the extraordinary stimulus deployed by central banks and government policymakers. Not in the least because up until today, the impact of that stimulus is being felt.

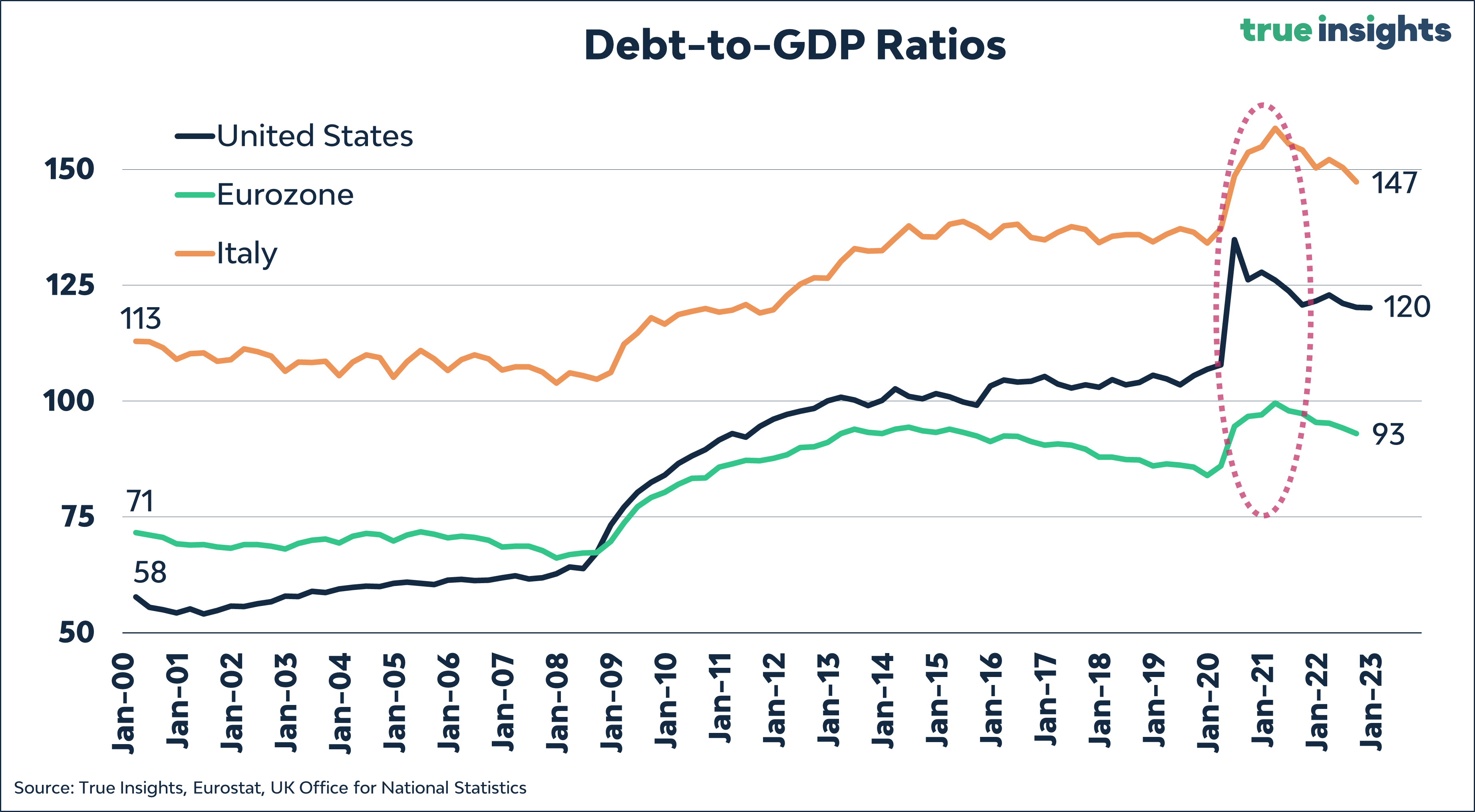

The chart below shows the Government Debt-to-GDP ratios for the United States, the Eurozone, and Italy. I have added Italy, because, in the Eurozone, the ECB determines monetary policy for the entire block, while member states effectively determine fiscal policy. In practice, the ECB will aim monetary policy at the Eurozone’s weakest link to ensure debt sustainability. I will extensively discuss this (impossible) combination and its impact on monetary policy in Part IV of the series.

Debt-to-GDP ratios have been rising for decades and spiked during the Covid lockdowns as governments came through with massive stimulus to dampen the impact of the economic sudden stop. As you can tell from the chart, even though GDP growth has been relatively strong since lockdown measures were removed, debt-to-GDP ratios remain significantly higher than pre-Covid.

Want to continue reading this blog? Then sign up using this link to read the rest, and be the first to receive the entire series of articles about Inflation and Investing in your inbox.

Jeroen Blokland

Hi, I'm Jeroen Blokland and I've been what they call a multi-asset investor for a long time. After working for Robeco, one of the largest investors in the Netherlands, for more than 20 years, I founded my own company: True Insights

True Insights provides independent investment research that helps you make better investment decisions and expands your knowledge of the financial markets. We will keep you informed of all important market developments and show you how to respond to them. We create well-diversified investment portfolios that invest in more than just stocks and bonds.

Sign up for free today

On Nxchange you can invest and trade in promising high growth companies, green assets, sustainable businesses and real estate.