WelMac

Teelt van macadamia's, teelt van macadamia-bomen, verwerking van macadamianoten en handel in de verwerkte eindproducten.

Company summary

WelMac is een verticaal geïntegreerd macadamia bedrijf met activiteiten in de gehele industrieketen. De teelt van de noten gebeurt op een zo duurzaam mogelijke manier, waarbij het terugdringen van het gebruik van water maar ook chemicaliën succesvol wordt gecombineerd met het maximaliseren van de opbrengst per hectare.

Door gebruik te maken van de nieuwste technologie en managementmethoden bereiken we niet alleen economische efficiëntie (zoveel mogelijk voedsel tegen een beheersbare prijs), maar ook ecologische efficiëntie, door slimmer gebruik te maken van natuurlijke processen en zuiniger om te gaan met grondstoffen.

Leadership

Testimonials

Om het aanbod veilig te stellen, ontwikkelt Intersnack strategische partnerschappen met gelijkgestemde bedrijven. Eén van deze samenwerkingsverbanden is met Welmac. In het geval van Welmac gingen we nog een stap verder dan in een gebruikelijke zakenrelatie.

In september 2019 hebben we een lening van € 2 miljoen verstrekt aan Welgevonden Macadamia B.V. (WelMac) om hun boerderij in Zuid-Afrika uit te breiden. Daarvoor waren we al indirect betrokken bij WelMac via een private equity-investering van het Forest Effect Fund, deels gefinancierd door DGGF.

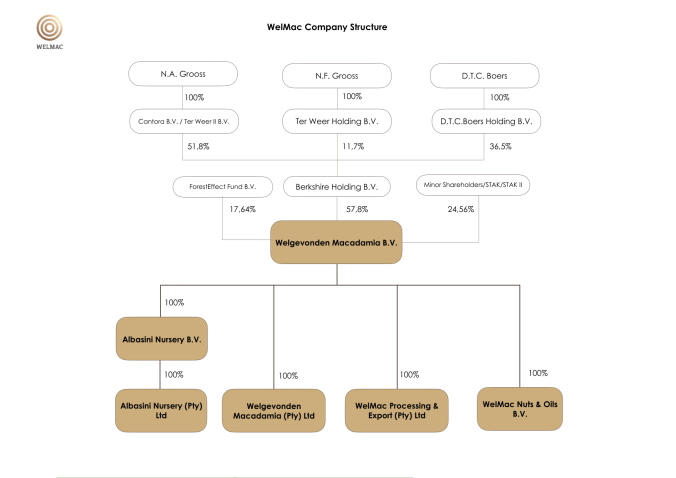

Company structure